Why Invest in Real Estate in Small- to Medium-Sized Cities?

At Ballast Rock, we specialize in investing in real estate in small- to medium-sized cities across the Southeastern USA because our experience shows properties in these cities often offer better opportunities to add value (i.e. “alpha”) and increasingly more significant market rent growth potential in the current market environment. As demonstrated in the graphs below, we have been able to outperform our own underwriting on our current portfolio both in terms of cap-rate and rent growth because - in our experience - the demand/supply constraints in real estate are often particularly acute in smaller markets compared to primary markets. In this article we will highlight some of the quantitative data that explain our investment thesis and provide some qualitative reasoning for this opportunity.

These two graphs were built using Ballast Rock internal data, comparing our expectations with the realized performance over two years since acquisition for all assets in Sunbelt Fund I and Sunbelt Multifamily Fund II thus far.

Quantitative Data:

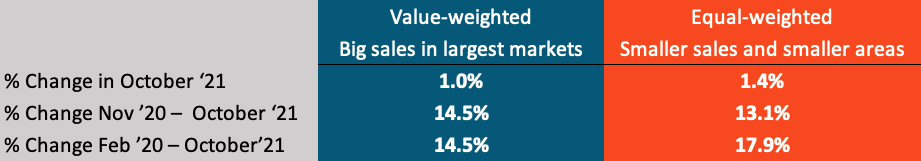

Costar (one of the main real estate industry data providers) has sales indexes that track two segments:

i) “value-weighted,” meaning big sales in the largest markets, and,

ii) “equal-weighted,” made up of more numerous but lower-priced sales in smaller areas.

Both moved higher in October, but the equal-weighted U.S. composite index advanced at a stronger pace:

Source: Costar

The above data demonstrates that pricing of smaller deals in smaller markets has outpaced larger deals in larger markets since the onset of the pandemic. Given the above, we wanted to provide some qualitative rationale as to why we believe we are able to add more value add in smaller markets compared to larger markets.

Qualitative Reasons:

‘Mom-and-Pop’ Owners:

Some of our success stories (Huntingdon, Holiday Cove, Spring Lake, Amelia West) have come when buying properties that are owned by ‘mom and pop’ owners. Whether it is a single real estate owner/operator, a couple that is managing their nest egg, or a family that has owned the property for years, there are frequently immediate avenues for upside when buying from these types of sellers.

To provide a concrete example we can look at Huntingdon in Albany, GA. The prior owner was a family that had owned the property for 30+ years. The below bullet points highlight the types of mismanagement that we frequently see when buying from mom-and-pop sellers:

They were running improvements and typical capex spending above the line which resulted in $2.5-3k/unit/year in above-the-line repairs & maintenance cost. Our typical expectation for an asset of this vintage is $600-900/unit/year in repairs & maintenance cost.

One of the family members was spending tens of thousands on custom cabinetry for apartments that rent for $600-800 in Albany, GA where a new basic set of cabinetry is available (at a cost of $3-4k/unit) and would return the same rental premium.

They were paying all 3 of themselves salaries through the community, resulting in a total of six staff members for a community that would typically run 2-3 staff.

Fayetteville, NC is an example of a city in which Ballast Rock invests.

Less Competition from Other Buyers:

In our experience, there is a smaller buyer pool in secondary/tertiary markets than in primary markets. Because of this smaller buyer pool, we see fewer bidding wars during fully marketed processes, and we are frequently able to acquire assets at a discount relative to the cap rates at which similar vintage/sized properties would have traded in primary markets (based on CoStar data).

No Daily Pricing Software for Rents:

In larger urban markets with more competition, many larger operators tend to use daily pricing software to set their rental levels. This daily pricing software tracks the rental levels of other comparable properties and will frequently undercut prices in order to better generate demand for properties. In smaller markets without daily pricing software, we can manually set our rents on a monthly or bi-monthly basis without having to worry about daily/weekly shifts in rental levels.

Columbia, SC is another example of a city in which Ballast Rock invests.

Brokers Not Maximizing Sale Proceeds:

Typically, price per unit (and total deal size) in secondary/tertiary markets trails that of primary markets according to Costar data. As a result, there are fewer brokers competing for business and listing agreements in these markets. Because of the reduced competition, we have found that brokers will fall short on pricing for a variety of reasons:

Inexperience: the brokers that work these smaller deals are generally the junior members of their team. This lack of experience frequently manifests itself in a lack of attention to detail on underwriting. Whether the broker misses an avenue to add ancillary revenue or an expense line item that is due to be cut, this inexperience can result in incorrectly priced underwriting.

Resource management: because of the lower fee sums for smaller deals, brokerage shops will often allocate fewer internal resources to the sales of these assets.

Smaller brokerage shops: because of the competition in primary markets, we have found that a lot of smaller brokerage shops target smaller markets in order to have a better shot at securing listings. These smaller shops frequently do not have the same mailing list of the larger shops, which results in fewer eyes on any given deal.

At Ballast Rock we help originate and distribute countercyclical and recession resilient real estate funds. Please feel free to connect to learn more about how we work with experienced real estate professionals to offer investors the opportunity to invest in income producing assets with a positive social impact.