Portfolio Strategy: Investing for the Soon to be Retired

Even for those with the earnings, wealth, and foresight to capably prepare, being financially ready for retirement can be a daunting task. Research on the subject is widespread and can become a winding labyrinth of vendors pitching their specific product solution. In this article we attempt to summarize some of what we believe to be the most relevant and interesting materials out there and provide the perspective that educates our investing decisions.

At Ballast Rock Capital we believe that each investor’s goals are unique, but that there are common strategies used in a customized mix to achieve these goals. It is standard advice that by diversifying one’s portfolio across liquidity and value creation methods, while accounting for leverage and taxability, one can lower the impact of market events, and best prepare to live comfortably through retirement. However, how can investors best understand their own situation, set goals, and start to plot out this customized mix of investment strategies? In this article we lay out a framework to answer this question in three steps.

Step 1: Understanding Where You Stand

Step 2: Set up a Long-Term, Short-Term, and Spending Reserve Account

Step 3: How to Think about Deploying the Long-Term Bucket

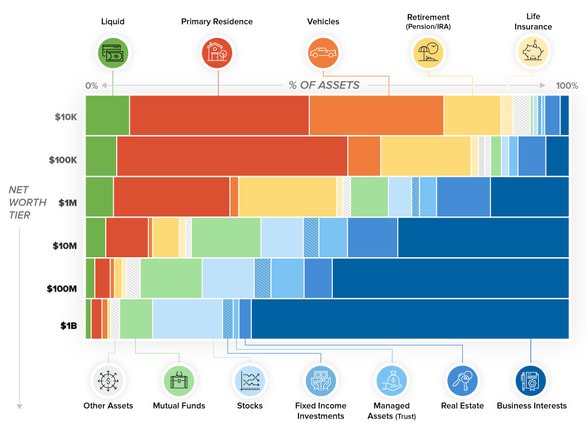

What Assets Make up Wealth?

Source: Visualcapitalist

Step 1: Understanding Where You StandAssess Your Net Worth and Earnings: In order to understand how to invest for retirement investors must first assess their current net worth, their forward earnings potential, and their expected future net worth at the time of retirement. Investors can find net worth calculation sheets across the web such as this one from Kiplinger.

Having calculated current net worth, investors should consider their forward earnings potential. Forward earnings potential is a conservative expectation of an individual’s future earnings prior to retirement (including Social Security, pensions, etc.).

Subtracting expected annual expenditures from forward earnings potential will give investors their expected savings capacity. Adding current net worth to expected savings capacity and factoring in a growth factor based on risk appetite will enable investors to estimate their expected future net worth at the time of retirement. A written version of this equation can be seen below.

(Current Net Worth) x (1 + Growth Rate)^Time + Future Savings Capacity = Retirement Net Worth

Assessing your future net worth is important for the purpose of understanding how much you can spend in retirement. The ideal situation is not spending more than the income/growth generated by one’s retirement net worth. However, this may not be achievable by many, or may lead to an overly conservative retirement lifestyle. A more realistic strategy is the Safe Withdrawal Rate method. This method dictates that individuals withdraw a percentage of their portfolio annually – 3-4% is a commonly accepted rate by most financial advisors – in order to cover living expenses.2 Naturally, an individual’s decisions about spending will be influenced by the market climate, life expectancy, and desire to leave an inheritance.

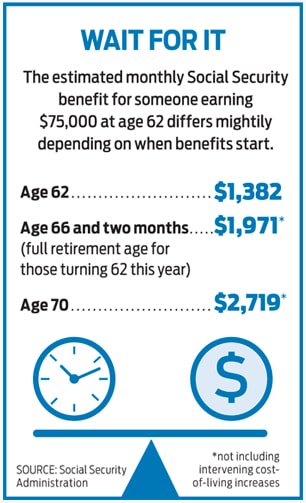

Social Security by Age

Source: Kiplinger

Distance from Retirement: The number of years remaining until retirement will influence what types of assets an individual holds and the savings strategy that the individual will employ. Individuals in their 40’s, who are targeting a retirement at 60, might need to take a more aggressive approach to investing, allocating a higher portion of their assets into small-cap equities, real estate, and business interests. Conversely, individuals in their 60’s, who are on the eve of retirement, may take a more conservative approach to investing, allocating a higher portion of their assets into lower risk investments like blue chip equities, bonds, and certificates of deposit.

Another thing to consider for investors who approach retirement is when to start withdrawing Social Security checks or other age-based pension plans. Per the Social Security Administration, individuals who withdraw their first check at age 62 earn half as much per month as individuals who withdraw their first check at age 70. Those who can postpone withdrawing until the later age are able to benefit from a lower withdrawal rate from their savings, effectively preserving their net worth and providing a larger nest egg going into retirement.

Risk Appetite: The final factor in determining how investors should allocate their assets is to determine their risk appetite. Risk appetite can generally be understood as the level of risk that investors can accept in pursuit of their objectives.

Some investments, like equities or real estate, can significantly appreciate in value while bearing the risk of potentially depreciating in value, while other investments, like bonds and treasuries, will return a stable rate of return and the face value of the investment, but with less risk of depreciating in value if held to maturity. Individuals who are confident in their potential forward earnings should have a higher risk appetite, accepting that losses may occur but that their earnings will make up for those losses. Conversely, the opposite would also be the case.

Retirement Bucket Strategy

Source: SeekingAlpha

Step 2: Set up a Long-Term, Short-Term, and Spending Reserve AccountEvery investment has a different time horizon and level of liquidity. As a result, it is important to allocate capital in a manner that allows an investor to maximize the value of those investments while still having an adequate amount of liquidity to pay for every day expenses.

The distinction between the long-term portfolio and a short-term reserve is important. Per SeekingAlpha, “on average, over the last 50 years, it took the S&P 500 about three years and eight months to recover from a downturn.”3 If, during a downturn, investors have too much money allocated in illiquid investments like hedge funds or private equities, they will either be unable to exit these investments or may have to exit them far below market value. To counteract this concern, investors can allocate 12 months’ worth of expenses in a liquid cash account and an additional two to four years’ worth of expenses – based on their risk appetite – in short-term bonds or bond funds that are relatively recession resistant.4 Investors should then regularly rebalance their investments in order to maintain the balances that would support spending through a potential downturn. Through grouping investments into a long-term portfolio, short-term reserve, and a spending account, individuals can be in the position to live comfortably without having to potentially sell any investment below that investment’s market value.Step 3: How to Think about Deploying the Long-Term BuckeTBefore deploying the long-term portfolio bucket it is important to understand what differentiates one investment from another. Four of the key investment differentiators are liquidity (or lack thereof), whether the investment generates value through income production or capital appreciation (i.e. method of creating value), whether the asset is levered or unlevered, and how the asset is taxed.

Asset Liquidity: Asset liquidity can be thought of as the degree to which an asset can be quickly bought or sold in the market at a price reflecting its intrinsic value.5 The driver of an asset’s liquidity – or the lack thereof – is the volume of transactions and the spread between which buyers and sellers are willing to transact. To give examples, assets such as U.S. Treasury Bonds and S&P 500 NYSE listed equities are generally considered liquid investments. Given the volume of outstanding bonds and frequencies of trades, an investor should be able to exit at or slightly below the prevailing market price with considerable ease.6 Conversely, assets such as partnership shares in hedge funds and penny stocks are illiquid investments. Due to the lack of both volume and frequencies of trades, it is often difficult for buyers and sellers to agree on a fair market value.7 An investor should always consult with a registered financial advisor in order to understand the liquidity levels surrounding a given investment. Through understanding liquidity, an investor can structure their portfolio to contain both liquid and illiquid assets. In doing so they will better prepare themselves for times of market volatility.

Value Creation: While not mutually exclusive, the way in which assets create value for an investor can generally be broken out into two categories: assets that produce a steady income stream and assets that appreciate in value. Investments like bonds and annuities are strictly income producing. While they return the face value of the original investment at maturity, they return a low but steady rate of return on a periodic basis. Conversely, investments such as small cap equities or hedge fund shares focus almost exclusively on capital appreciation. They do not typically return dividend payments, but rather focus on generating value through enabling investors to exit the investment at more than what they paid to enter. There are also investments that encompass both income production and capital appreciation, such as real estate funds and dividend-paying equities. Through returning a portion of annual profit, investors benefit from the success of the company’s operations. However, this often comes at an expense of capital appreciation, as every dollar that a company pays out is a dollar that is not re-invested into improving the operations of that company. Still, investors are able to benefit from the best of both income production and capital appreciation.

Leverage: Leverage is the use of debt in an investment. Leverage can amplify returns but also potentially losses and is commonly used in real estate and hedge fund investing. Leverage is incredibly valuable when the investment goes well – returns can be increased by a multiplicative factor. By the same token, however, leverage will amplify the extent to which an investment goes poorly when something goes awry. When considering an investment that utilizes leverage an investor needs to factor that leverage into the risk adjusted return and determine if that fits their risk appetite.

Taxable, Tax-Deferred, and Tax-Exempt Investment Vehicles: Investing in tax-deferred or tax-exempt structures can provide a powerful tool to help investors amplify returns and reach their retirement goals more rapidly. This is a complicated subject and would require its own article, but we recommend investors consult with a qualified tax advisor in order to fully understand the issue.

Conclusion

Planning for retirement is complicated and is something that is done best when consulting with a combination of advisors (i.e. legal, financial, tax). However, once an individual knows where they are (having understood their net worth) and where they want to be (having set their financial goals), creating the right mix of commonly used strategies is relatively straightforward.

At Ballast Rock Capital we help originate and distribute investments that can be a part of an investor’s retirement planning portfolio based on their risk appetite. Please feel free to connect to learn more about how we work with experienced real estate professionals to offer investors the opportunity to invest in income producing assets with a positive social impact.

-

Please consult your own independent advisor as each investor’s situation is different.

https://www.investopedia.com/terms/s/safe-withdrawal-rate-swr-method.asp

https://seekingalpha.com/article/4251652-investing-income-retirement?page=3

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counter-parties. Unlike individual bonds, most bond funds do not have a maturity date, so holding them until maturity to avoid losses caused by price volatility is not possible.

https://www.investopedia.com/terms/l/liquidity.asp

https://www.investopedia.com/articles/trading/11/understanding-liquidity-risk.asp

https://investinganswers.com/dictionary/i/illiquid