Investing for an Accommodative Fed and Post-Pandemic Inflation

Wednesday September 16th’s Federal Open Market Committee (“FOMC”) telegraphing of their hyper accommodative future policy strategy(1) should prove a boon for multifamily real estate investors, not only keeping interest rates lower for longer, but shifting to prioritizing growth and employment over the Fed’s prior dual focus of growth and inflation management.(2) It is small wonder that the Fed has taken this marked change in stance on inflation, not only to allow for more rapid growth but also to diminish the long-term burden of managing the massively bourgeoning national debt required to fund pandemic rescue packages.(3)

The FOMC states that they will not raise rates “until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.” Inflation and full employment will be required before the Fed will consider a hike. Both conditions, not one or the other, must now be met so inflation must actually reach 2.0% and be expected to sustain that level.

As a result of this distinct difference in stance on inflation, a number of investors have asked if investing in multifamily real estate is an effective way to hedge against potential future higher inflation. We believe that yes, it can be. If the Fed is now willing to allow for inflation to tend well above recent historic levels to achieve their targeted growth and full employment, inflation would exceed capital market expectations and risky assets could underperform. As such, many investors are considering inflation indexed income generating assets such are multifamily real estate which may offer greater protection against a potential increase in inflation.

In this article we discuss:

likely U.S. economic scenarios for exiting the pandemic recession;

headline vs. housing inflation, and national vs. Southeastern regional inflation; and

whether multifamily real estate can be a good hedge for inflation

There are two broadly expected scenarios within the real estate industry(4) for the United States’ economy as we recover from the recession brought on by the COVID-19 pandemic: (1) “return to normalcy”, and (2) “potential stagflation”. It is our house view that the latter is more likely at this time.

In the first “return to normalcy” scenario there is expected to be modest economic growth of 1.5-1.8%, accompanied by similarly modest inflation. This scenario is spurred on by progress on a COVID-19 vaccine in Q4 2020 and distribution of the vaccine in 2021, leading to a growth in the labor force and an acceleration in returning to full-employment in the labor market.

In the second “potential stagflation” scenario there is expected to be poor economic growth accompanied by increased inflation. This scenario is brought on by a continued poor containment of COVID-19, slower than expected return to full-employment, and deteriorating financial conditions as the U.S. economic recovery lags behind the rest of the world. While office, non-essential retail, and luxury multifamily real estate will continue to struggle with occupancy and rent growth, we believe most multifamily, especially workforce housing, will at least keep lock step with inflation as renters are forced to downgrade property classes.

It is our view that the U.S. economy is in a more sustained economic downturn than might be implied by the buoyancy of the U.S. stock market (which in our opinion is being artificially propped up by Fed liquidity). Additionally, though there is limited national headline Consumer Price Index (“CPI”)(5) inflationary pressure for the medium-term, there are sub-sections of CPI (such as “shelter” - primary residency rent and homeownership equivalency) with higher inflation risk, along with significant regional pockets of higher inflation relative to national averages in locations like the Southeast where there is stronger economic and wage growth.

The table below shows national rent increases relative to those in North Carolina, South Carolina, and Georgia. Where national rent growth over the last 12-months has been zero, we have seen 2.3% on average across the three core states in which we invest.

Source: CoStar, data pulled 9/24/2020

Is multifamily real estate a good hedge for inflation? We believe the answer is yes. The shorter lease duration (typically 1-year) allows landlords to adjust rents based on inflation and market demand on a much more frequent basis. Because we have lease renewals every day across our portfolio, we are constantly monitoring local market comparable properties and rent increases (i.e. supply) and comparing it to our incoming rental demand from existing and new potential residents. This gives us daily price, demand, and supply data across our portfolio and our markets.

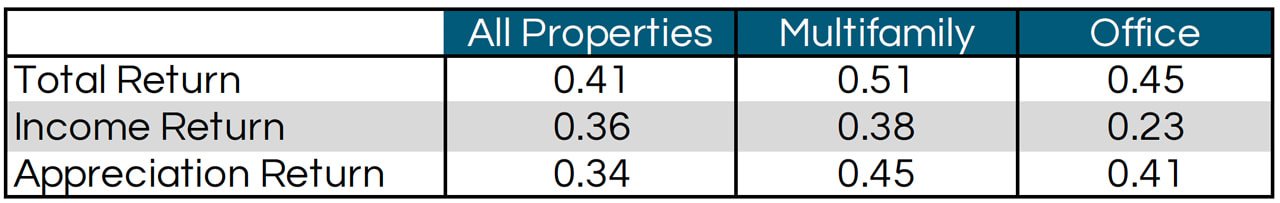

The table below shows the correlation between headline CPI inflation and investment performance across different types of real estate since 1979 (calculated quarterly). Multifamily returned the strongest correlation of .51, more than double that of retail real estate, and outpacing both office and industrial.(6) A large part of this correlation can be chalked up to the differences in lease duration: while an apartment’s lease tends to be a year, office, industrial, and retail tend to have much longer leases, lasting multiple years if not decades.

Property Type Investment Performance and Measurement with Inflation

Source: NCREIF-NPI, MSCI-IPD, Moody's Analytics, August 2020

Multifamily real estate historically has been a good hedge for inflation and given the strength of collections we have seen thus far compared to other sectors or real estate; we believe it can continue to offer relatively attractive risk-adjusted returns as the U.S. recovers from the pandemic recession. Multifamily real estate is poised to benefit from the Fed’s hyper accommodative stance enabling us to continue to finance acquisitions at low fixed long-term interest rates while providing an attractive hedge for any future high inflation.

If you have any questions about inflation risk management or multifamily real estate, please reach out to learn more.

-

Any links reference above lead to third party websites. The content thereof, their services, goods, or advertisements are not maintained or controlled by Ballast Rock. We can therefore not be responsible for the availability, content, accuracy, or privacy practices of this initial site or any linked websites. We provide this hyperlink to you for convenience only and the inclusion of any link does not imply any endorsement of the linked website. You link to any such website entirely at your own risk.